Rsu stock tax calculator

Use this Louisiana property tax calculator to estimate your annual property tax payment. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Now that you know the basics.

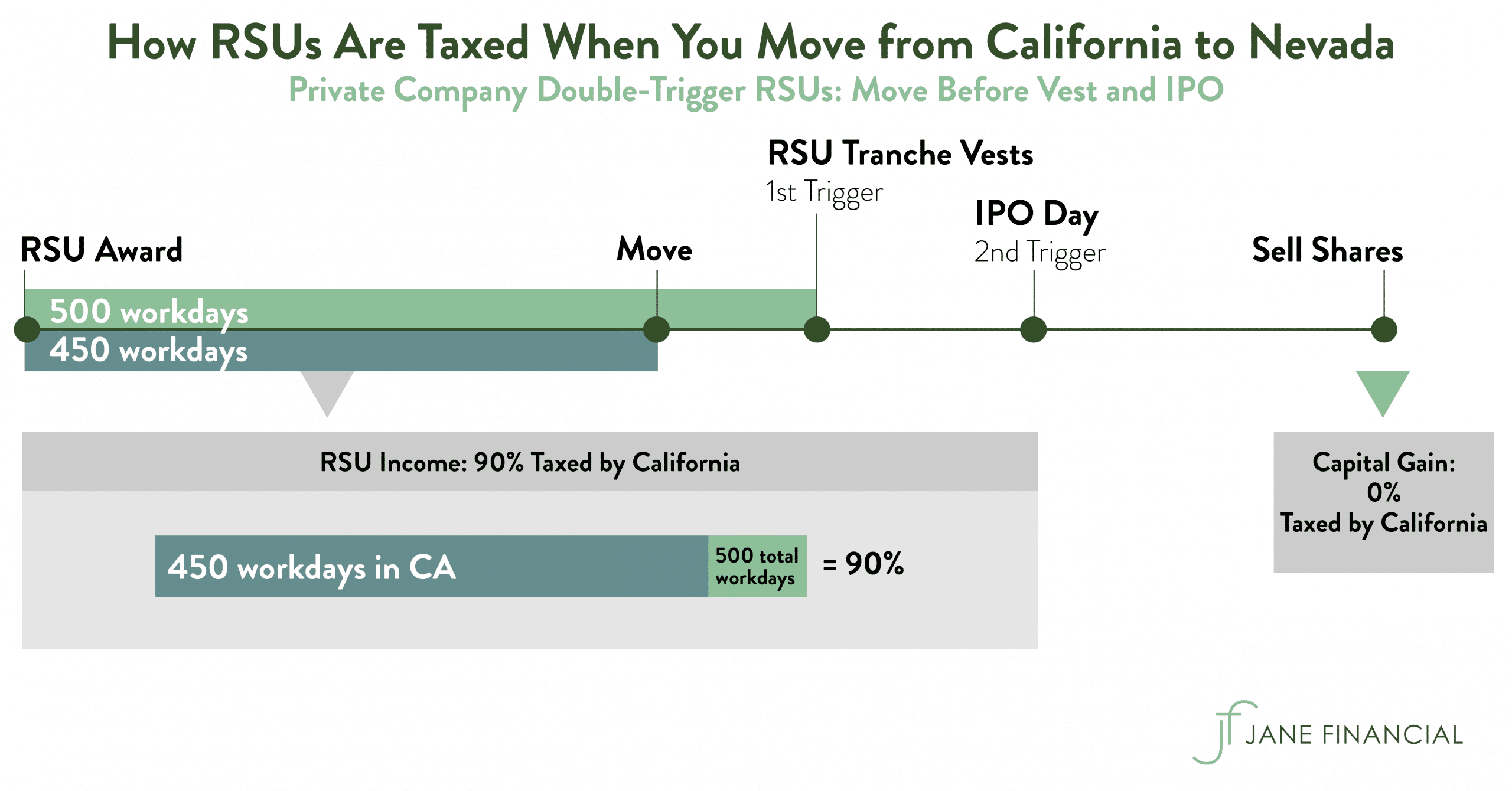

. New Orleans has parts of it located within. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. How Are Restricted Stock Units RSUs Taxed.

Capital gains taxes come in two forms. The average cumulative sales tax rate in New Orleans Louisiana is 943. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Ad Thinking of switching from stock options to RSUs restricted stock options. Compare how the total payout may change between options and RSUs. The IRS does not consider restricted stock units RSUs to be tax-deductible when compared to stock options.

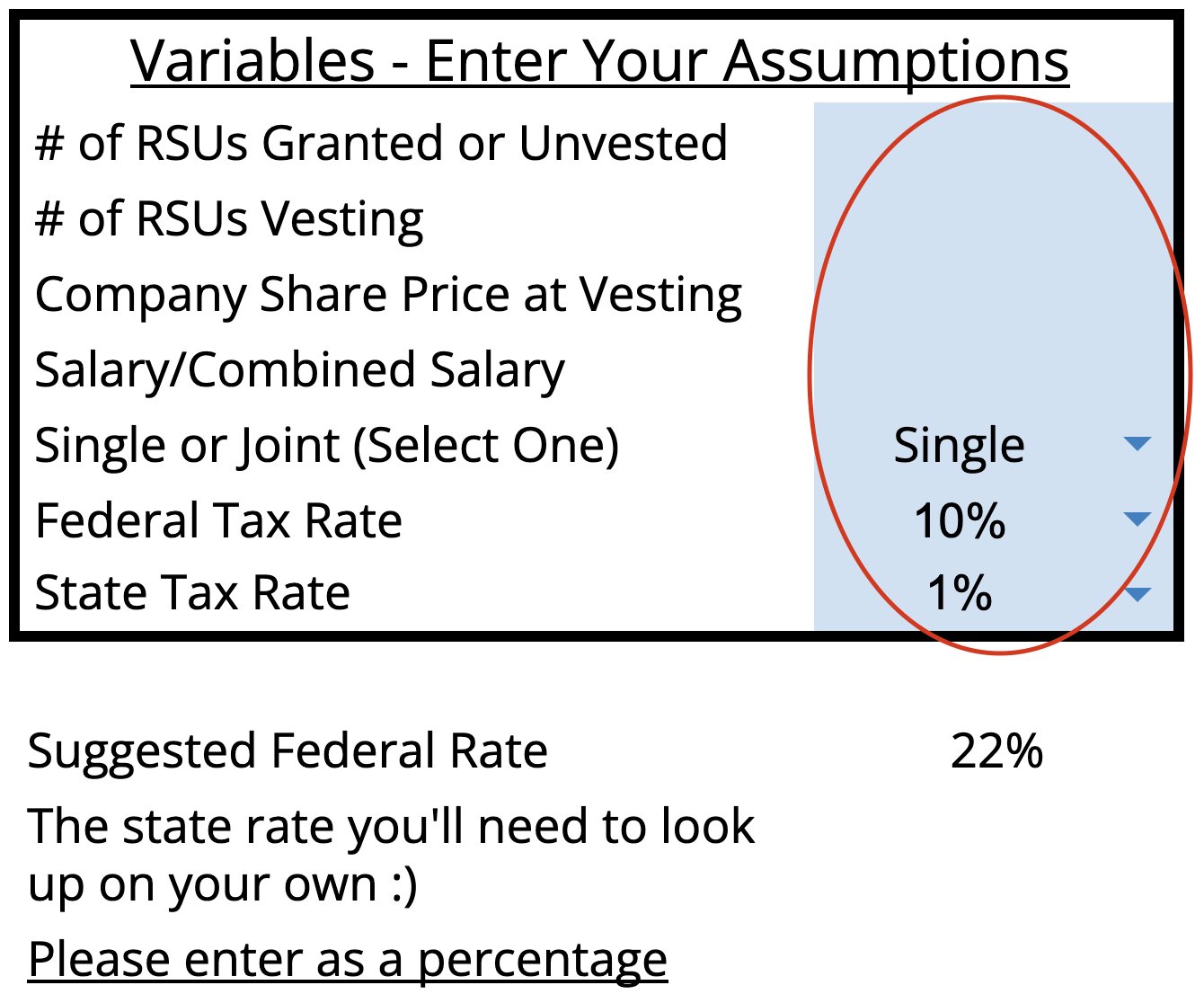

Discover Helpful Information And Resources On Taxes From AARP. Restricted Stock Unit Modeling Calculator Using the RSU Projection Calculator To use the RSU projection calculator walk through the following steps. Ad Thinking of switching from stock options to RSUs restricted stock options.

Enter the amount of your. Compare how the total payout may change between options and RSUs. Let us understand tcs tax.

Vesting after Social Security max. The calculator will automatically apply local tax rates when. Vesting after Medicare Surtax max.

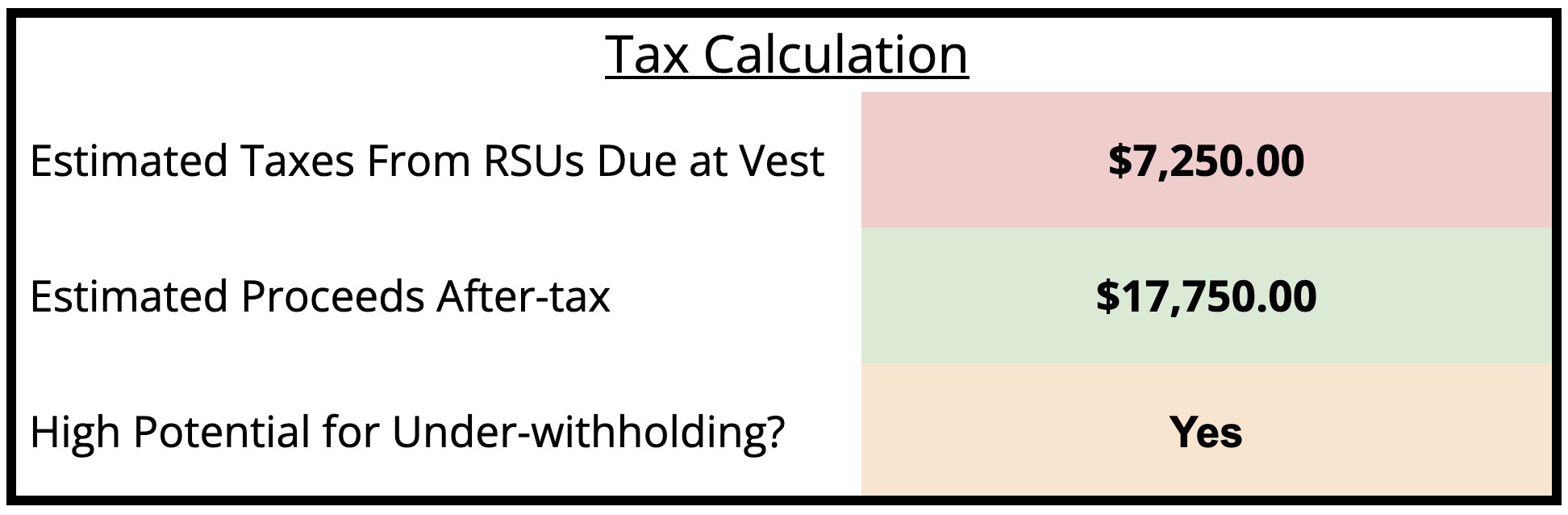

This is different from incentive stock. Estimate closing costs or New Orleans area property tax due on your property. RSU Tax Calculation Heres How to Check Theres a fairly easy way to check how much more you shouldve had withheld on your RSUs at vesting.

This includes the rates on the state county city and special levels. LTCG are taxes on stock you sell after owning it for 365 days or. When you receive the shares you must pay taxes on gains or.

Restricted Stock Units RSUs Tax Calculator Apr 23 2019 Off Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide. Vesting after making over. Feb 08 2022 amazons rsus currently vest 5 after the first year 15 after the second and then 20 every six months for the remaining two years.

Estimate your Louisiana Property Taxes. Your household income location filing status and number of personal. Vesting after making over 137700.

Long Term Capital Gains LTCG and Short Term Capital Gains STCG. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax.

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu And Taxes Restricted Stock Tax Implications

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Blog Upstart Wealth

Restricted Stock Units Jane Financial

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

When Do I Owe Taxes On Rsus Equity Ftw

Rsu Taxes Explained 4 Tax Strategies For 2022

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022